41+ How much money can i borrow from the bank

Estimate how much you can borrow for your home loan using our borrowing power calculator. Answer 1 of 4.

21 Free 41 Free Certificate Of Origin Templates Word Throughout Certificate Of Origin Template I Certificate Templates Certificate Of Origin Planner Template

Your monthly recurring debt.

. Calculate how much I can borrow. Enter a value between 0 and 5000000. Your annual income before taxes The mortgage term youll be seeking.

Theyll also look at your assets and. Suppose your car is worth 10000 and you. Under this particular formula a person that is earning.

When A 401 Loan Makes Sense. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Sometimes you need a little extra cash to get you through to your next paycheck or benefits check.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. By law 401 k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period. Once you know how much your vehicle is worth you can subtract the total from the remaining principal balance of your auto loan.

The 52-week low was 409 compared to a 52-week high of 450. Combined amount of income the borrowers receive before taxes and other deductions in one year. Answer 1 of 3.

If you dont know how much your. How long it will. Figure out how much mortgage you can afford.

How much can you borrow from your 401k. Your financial future is established by making wise decisions with your money. Its common for lenders to offer loans up to 40000 or 50000.

Factors that affect how much you can borrow. Your Mortgages borrowing power calculator considers a few important factors that can determine your. Personal loans are often available in amounts ranging from 2000 to 50000 while there are certain lenders that provide personal loans in amounts up to 100000Even if a.

Most personal loan lenders limit the amount you can borrow. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. View your borrowing capacity and estimated home loan repayments.

Some lenders only offer personal loans up to 10000 while others such as online brokers can offer personal loans with a maximum loan amount of 50000. If you have no. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

In the normal run of business a healthy bank will not have to borrow money from the Federal reserve other than for short term technical reasons. When you mustfind the cash for a serious short-term liquidity need a loan from your 401 plan probably is one of the first places you should. For this reason our calculator uses your.

Best Places to Borrow Short-Term Money Online. Such a bank will be able to. Find out how much you could borrow.

Theres not enough information in the question to provide a definitive answer but I would like to correct some of the misinformation here. The interest rate youre likely to earn. How much money can you borrow from the bank.

Lenders do not look at the borrowers. By using our free financial calculators you can evaluate your options for. Plan today for a better tomorrow.

.png)

On The Number 41 Part 1

/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)

Pre Money Vs Post Money What S The Difference

.jpg)

On The Number 41 Part 1

How To Stay Motivated To Save Money Like A Boss

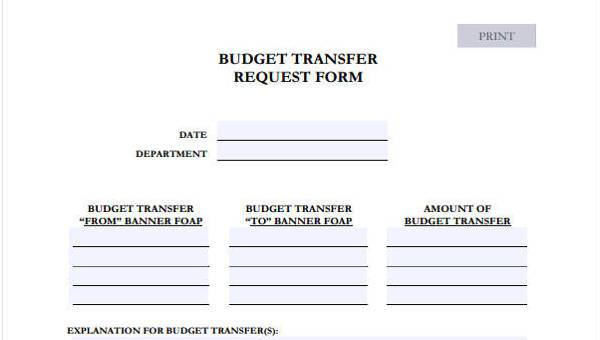

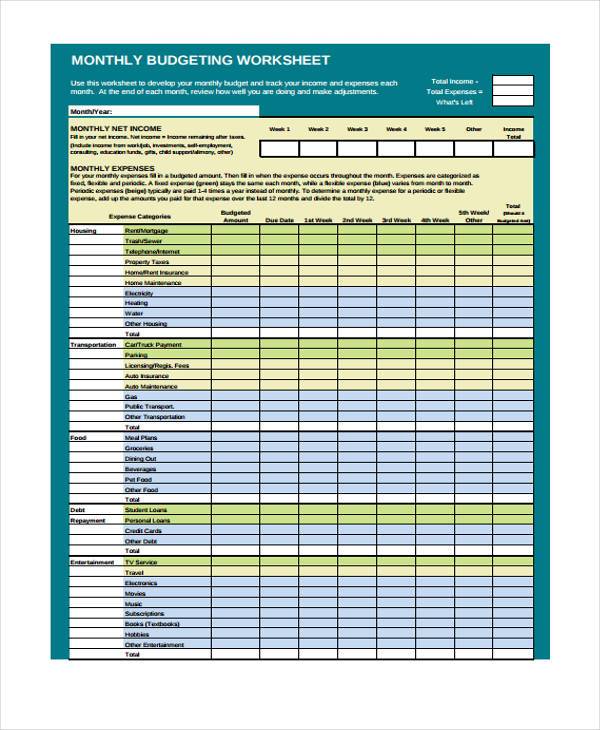

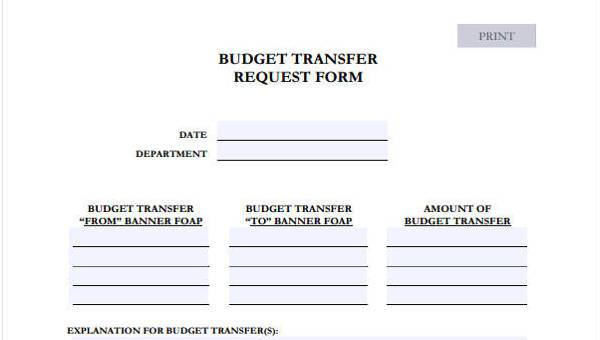

Free 41 Budget Forms In Pdf

41 Startup Terms And Metrics You Need To Know Stride Blog

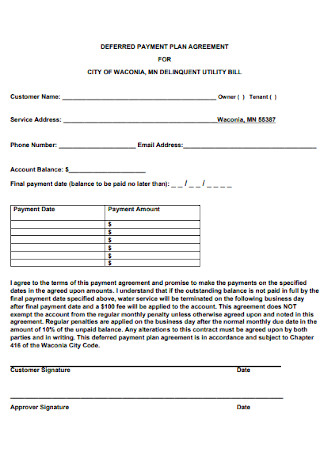

41 Sample Payment Plan Agreement Templates In Pdf Ms Word

.jpg)

On The Number 41 Part 1

41 Sample Payment Plan Agreement Templates In Pdf Ms Word

.png)

On The Number 41 Part 1

Free 41 Budget Forms In Pdf

3 Photography Banners Template Free Psd Banner Template Banner Template Design Banner

.png)

On The Number 41 Part 1

.png)

On The Number 41 Part 1

41 Sample Payment Plan Agreement Templates In Pdf Ms Word

41 Fake Transcripts Free Download Online College Word Pdf High School Transcript Homeschool Transcripts Homeschool Planning

Free 41 Budget Forms In Pdf